Much of shipping’s future fortunes rest on factors that have little to do with ships…

Richard Meade, the Lloyds’ List

People who commit their lives to work at sea usually are not good with crystal balls, but there are facts we can use to create a reliable prognosis of what awaits the global shipping industry in 2022 and beyond.

There are three main topics in this article:

- Figures and results of the maritime industry for the past year.

- Shipping industry outlook 2022 – 2023.

- Seafarers hopes and concerns for the next few years.

Key Shipping Trends in 2022

Any forecast stands on the firm ground of the facts, so let’s check what do we know about the modern maritime industry:

The Structure of Merchant Fleet in 2022

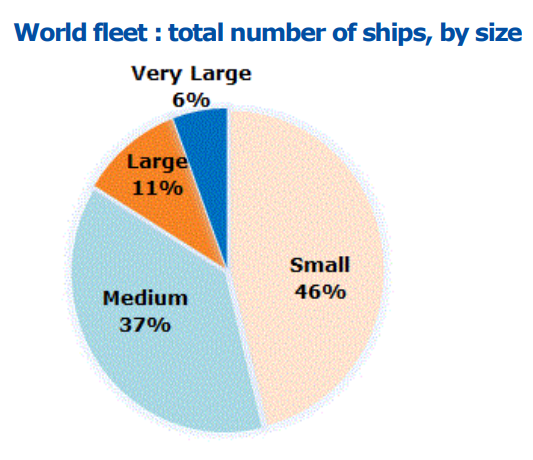

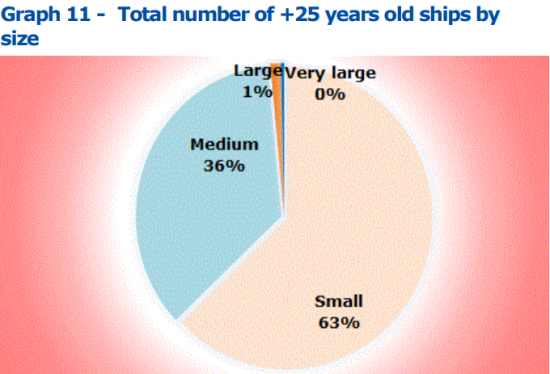

In spite of big ships being the newsmakers in chief, the majority of vessels in the world are small. 46% of all ships in the world are below GT 500. These are mainly fishing vessels and tugs, by the way.

Meanwhile, these small vessels appear to be the oldest (25+ years old) as well. On the contrary, 0% of very large ships reach the 25th anniversary; and the tendency magnifies as the quantity of new buildings grows year by year.

Thus, in 2020 the global fleet increased by 3%; and is expected to grow by 4.5% in 2022. The container liner fleet reached 24.97 MTEU on 1 January 2022, for example; while order books predict a record 7.5% boost in 2023.

Changes in Capacity Deployment

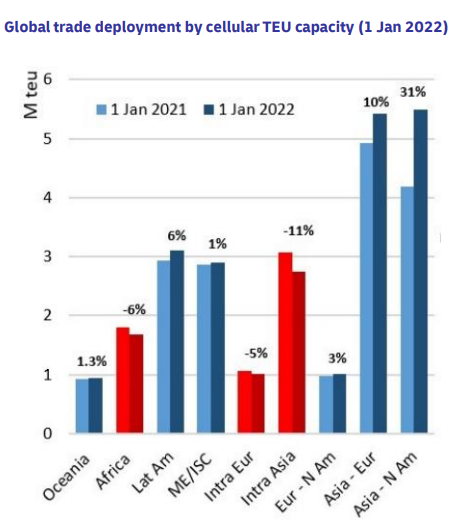

There has been a significant change in trade routes for the past two years of the Covid-19 pandemic, so today 41% of the container ship capacity is deployed on the two largest East-West trades (mainly from Asia to North America).

The tendency is explained by the change in the consumer behavior during lockdowns from services to utility goods which are manufactured predominantly in the Asian countries.

The consumer goods euphoria of the pandemic years exacerbated a significant change in the manufacturers behavior. Due to the delays and uncertainties, many companies switched from ‘just in time’ to ‘just in case’ mode, preferring to store supplies rather than suffer from the delayed delivery.

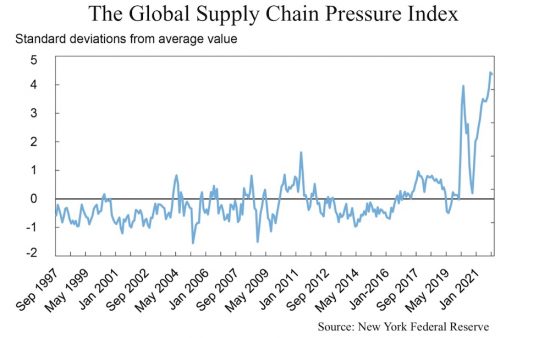

These factors have resulted in an unprecedented surge in container shipping operations. For instance, the Shanghai Containerized Freight Index hit a record in the last week of December 2021 with 76% year on year and topping 5,000 points for the first time.

Port Delays

There were 101 container ships waiting for berths in Los Angeles/Long Beach one sunny December morning in 2021. This was very close to the collapse; and massive port delays were spotted all over the world for the past year.

Unexpected port closures inflicted by Covid-19, a disastrous lack of port workers and truck drivers, ship crews kicking up their heels on vessels without an opportunity to go ashore were typical all over the world have become a true sign of the times.

Moreover, lengthened time of discharge in ports partly contributed to the container shortage and astronomical freight rates.

Crew Change Collapse

The global trade survived the past two years thanks to the maritime professionals. Meanwhile, the latter were denied a right to leave their job on board for many months. In the latest Seafarers’ Happiness Index report 5% of shipping professionals admit being on board for more than 12 months; and 13% remaining on their vessels over 9 months.

In our Seafarers Health and Welfare article we pointed out that the vaccination rate is steadily growing, so let us hope that the repatriation crisis is a trend of the past.

Shipping Industry in 2022 – 2023 Outlook

Once key features of the shipping industry’s development are numbered, we can proceed to a well-considered prognosis for this and the year 2023.

Fast Global Fleet Growing

A rapid increase in the number of vessels might seem scary, but in fact more container ships will ease the ships availability problem and lower freight rates. Supply -demand balance will be restored in coming years while seafarers will get more opportunities to build a career at sea on modern and comfortable vessels.

For instance, at least 22 large container ships will be delivered this year (COSCO Shipping, CMA, OOCL, MSC, etc.). Moreover, two new players emerge in the maritime market, i.e. Taiwan and Thailand. The first will launch 46 container ships in coming years; and the latter orders several container ships to be delivered by 2025.

Availability and Freight Rates

The Lloyd’s List experts predict freight rates to drop by 30-40% in 2022, though it is highly unlikely that they will return to the 2019 figures. Even new vessels that mushroom all over the world will be unable to mitigate the capacity crisis completely, so the prognosis is that freight rates will stabilize just around 2024.

The problem of vessels’ availability fueled by port delays and consumer priorities change might ease in the second half of 2022. It is expected that severe lock downs will be canceled by that time and people will reverse back to buying services instead of a surplus of toilet paper and washing powder. However, these sanguine expectations might be reversed at any time by another swing of the pandemic.

Port Delays

Infrastructure bottlenecks will occur here and there due to short-notice port closures initiated by the local outbreaks of Covid-19. This prognosis is based on China’s current zero-COVID strategy. The biggest ports in the world are located there, so disruptions in their work affect the whole industry.

The costs of the zero-tolerance policy are mounting, so there are more and more voices for China to accept the reality and abandon strict lock-down. For instance, Jin Dong-Yan, a virologist with the University of Hong Kong, admitted in his interview to Al Jazeera: “My advice would be that they (Chinese authorities) should adjust gradually and recognise the reality around the world on COVID-19….They should cease the policy step by step.”

Seafarers in 2022

The process widely known as a ‘supply chain disruption’ seafarers saw as a personal crisis. Many didn’t touch dry land for months which affected their physical and mental health severely.

The good news is that the tide is turning. With the growing level of vaccination among seafarers there are more opportunities for crews to disembark or travel without the nuisance of guaranteeing.

Many aspects of seafarers’ welfare will obviously depend on the next ‘move’ of the pandemic, but the tendency today is for the liberalization of flight restrictions and less crew change issues.

The latest Seafarer Workforce Report from BIMCO and the International Chamber of Shipping (ICS) predicts a dangerous shortage in maritime officers by 2026. The industry might need additional 89,510 officers by that time; and the pandemic magnified existing challenges.

This is an ambivalent conclusion as it means that more jobs at sea will be available for trained maritime professionals, but the industry obviously needs to change its approach to retention and training.