Most seafarers know that working at sea brings unique financial opportunities. But what many don’t realize is just how generous Dutch tax law can be – if you file correctly. According to Aangifte24.com, a Dutch tax advisory firm specializing in maritime taxation, 70% of international seafarers miss out on thousands of euros in refunds every year.

The reason? Complex regulations that many standard accountants fail to apply.

Why dutch tax rules mean more money for seafarers?

The Netherlands provides special tax exemptions for crew members working under its flag. These rules are not loopholes – they are written into Dutch law to support the maritime industry.

Key benefits include:

- Partial or full exemption from Dutch income tax if you work outside Dutch territorial waters for a sufficient number of days.

- Application of the 183-day rule, which can shift your tax residency status.

- Double taxation treaties that ensure you’re not taxed twice on the same income if you live outside the Netherlands.

- Dutch tax amnesty (abolition), which in certain cases cancels older tax debts if past returns were filed incorrectly or if your tax status has changed.

Together, these provisions create opportunities for seafarers to drastically reduce their taxable income -sometimes down to zero – and recover overpaid tax from previous years.

What is the Dutch tax amnesty (abolition)?

One of the least-known advantages is the abolition scheme. In practice, this means that if you were previously assessed incorrectly or failed to claim your maritime exemptions, the Dutch Tax Office may forgive old tax liabilities once your situation is corrected. Instead of paying past debts, you could be eligible for refunds.

This can turn a potential tax burden into a financial windfall.

Real-World example of tax refund: €4,153 tax back

A recent case handled by Aangifte24.com illustrates the scale of these benefits. A non-resident seafarer, employed by a Dutch maritime company, received €4,153 back from the Belastingdienst (Dutch Tax Authority) only for one tax year! The refund was only possible because the seafarer exemption and relevant treaties were applied properly via aangifte24 app.

Who qualifies?

These benefits are not limited to Dutch nationals. They apply to seafarers of many nationalities – including Poland, Lithuania, Greece, Croatia, the Philippines, Ukraine, India, Ghana, and more – if they:

- Serve on a Dutch-flagged vessel.

- Are paid through a Dutch employer or agent.

- Spend the majority of their contract outside Dutch territorial waters.

If this describes your work situation, you may be entitled to a significant refund – even if you’ve already filed your taxes.

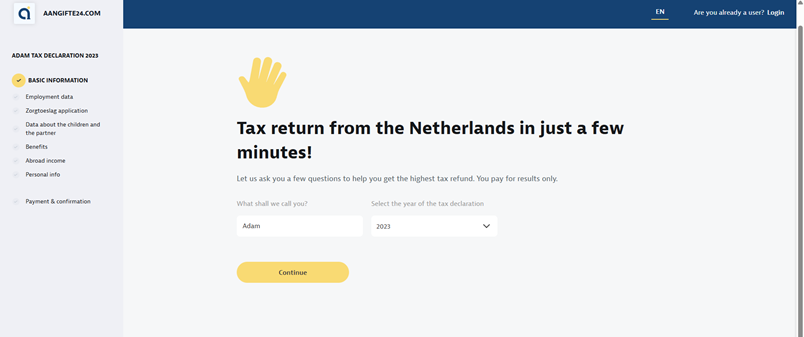

How to claim extra tax refund?

Recovering hidden refunds requires specialized knowledge. Aangifte24 advises:

- Work with maritime tax experts – general accountants rarely understand the complexity of seafarer exemptions.

- Keep accurate records of your contracts, port calls, and days spent at sea.

- Check past filings – in many cases, you can reclaim overpaid taxes going back up to five years.

- Apply relevant treaties to avoid paying tax twice on the same income.

- Consider the abolition scheme if past errors created artificial debts.

Don’t leave money with the Belastingdienst

Seafaring under the Dutch flag isn’t just about adventure – it’s about knowing your rights. If you’re not applying the correct exemptions, you may be leaving thousands of euros with the tax authorities each year.

👉 Find out how much you could recover with Aangifte24 – because your hard-earned money belongs to you, not the tax office.